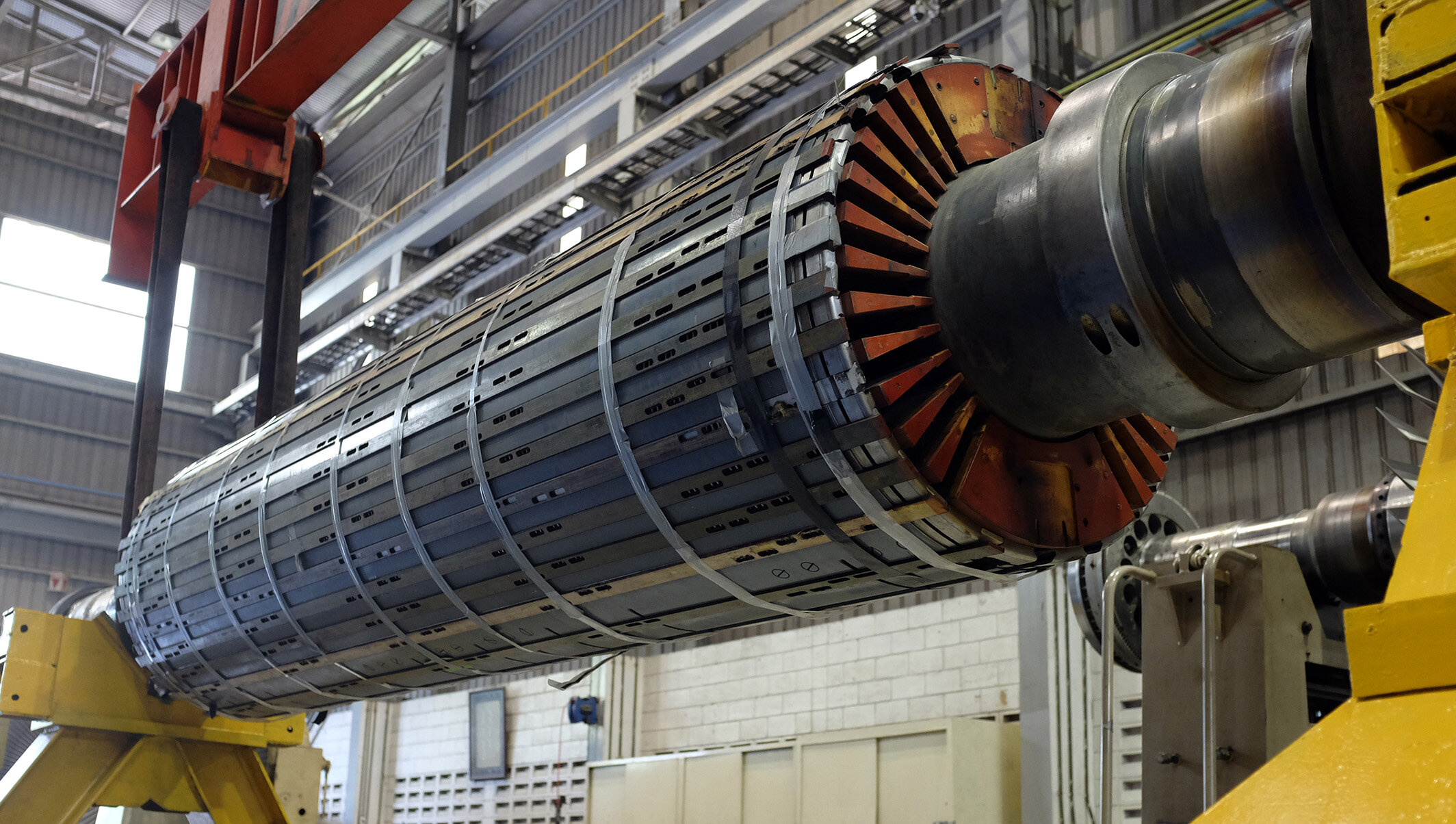

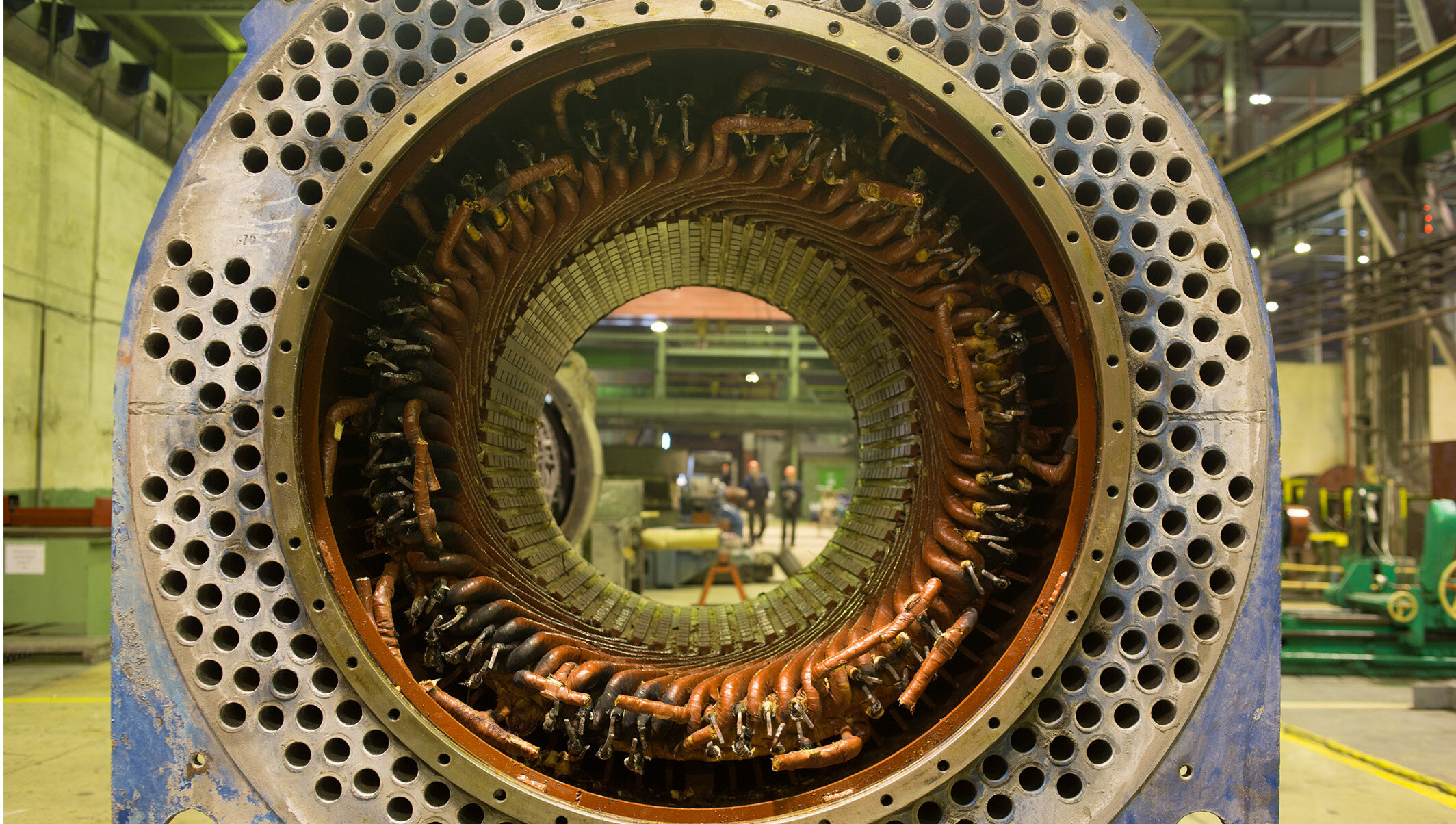

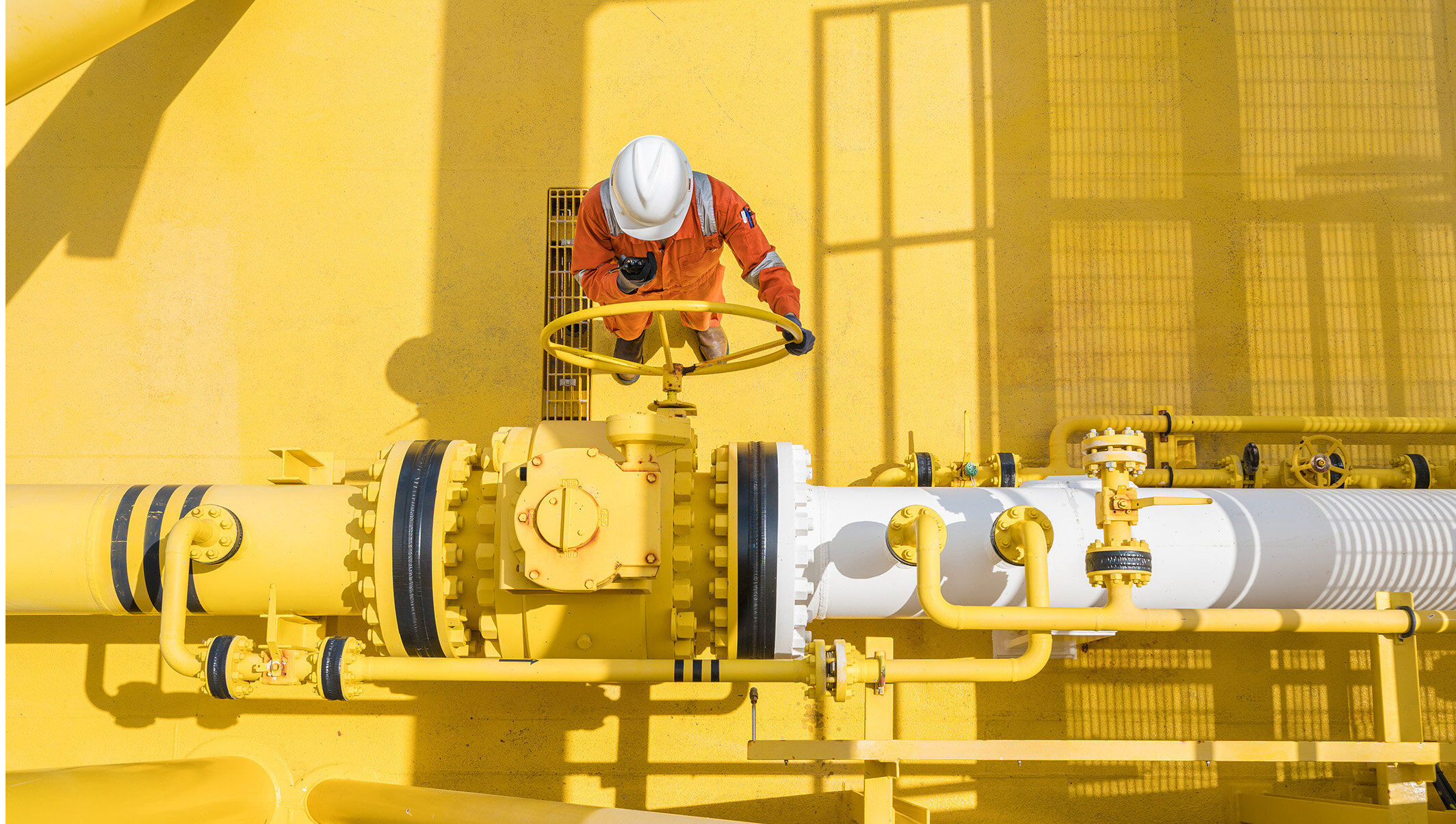

Family Office Investors (FOI) has been investing in private businesses for over 20 years. We invest in growing manufacturing, service and distribution businesses in the commercial and industrial sectors.

We partner with management teams operating defensible businesses with competitive barriers in markets where organic revenue growth and equity value creation opportunities are available through product, service, and geographic expansion, and add-on acquisitions.

We partner with family office capital and private equity funds that co-invest alongside us in new investment opportunities that fit our criteria.

We make long-term investments in businesses undergoing change, particularly industry or ownership transition.

We will consider investments in different end markets outside of our core focus that have a clear and compelling investment thesis.

“I met Mark in 2004 when he was part of a venture capital recapitalization of my company. Mark’s expertise helped the company grow its sales in excess of 25% per year compounded from $20 million to just over $60 million when it was sold again four years later. ”